Landlord Guide

Your Guide to Becoming a Landlord

ARE YOU READY TO PLAY THIS RISKY GAME?

Like any business venture, it is important to consider revenue, expenses, legal, and tax consequences.

WHAT TO CONSIDER

Typical expenses for a rental house may include…

Mortgage P&I

Interest rates for investment properties are typically higher than rates for your primary residence.

Taxes & Insurance

In addition to property taxes you will have to report rental income on your personal tax returns. Insurance is a key factor, see below for details.

HOA Dues

Homeowner’s Association Dues come straight off the top line. Worse, it’s harder to enforce codes on Tenant’s and you run the risk of incurring fines for being out of compliance on things like lawn maintenance, parking in street, etc…

Repairs & Maintenance

Not only will you have the burden of paying for repairs and maintenance, the bigger risk is not knowing when an issue arises. Often times, a Tenant may turn a blind eye or ignore a small problem until it gets extremely bad.

NOT AN EASY GAME

While being a Landlord can certainly be rewarding financially, it’s not an easy game to win.

REPAIRS & MAINTENANCE

Renters don’t normally trim bushes, clean gutters, change air filters, etc… so maintenance & repair costs for a rental home often are higher than for a home occupied by the owner. On average, most rental homes require a budget of 10-15% of the rental income towards repairs & maintenance.

Wear and tear for a one year rental usually results in the need to repaint the interior plus clean or replace carpet, depending on the age and how hard the house was lived in. Most rentals require $2000-$5000 per turnover with a new tenant. If a tenant intentionally damages property, the costs can be $10,000+.

INSURANCE

It is recommended the owner consider an umbrella insurance policy for liability reasons because if a renter sues an owner, the owner risks not only losing the house they are renting but all their personal assets can be at risk too. An umbrella policy protects against this risk and so does setting set up an LLC and putting the house in the name of the new LLC.

TAX & LEGAL

Legal or CPA help to draft a lease and review legal & tax issues for the owner. The owner pays income tax on the income from the rental which can be 20-35% +/- depending on the tax bracket. The owner depreciates the house on taxes but “recaptures” that depreciation when selling, which means the owner owes taxes on what they depreciate when they sell. In some cases, if a landlord lives in one state and rents a house in another state, they have to file income tax returns in both states.

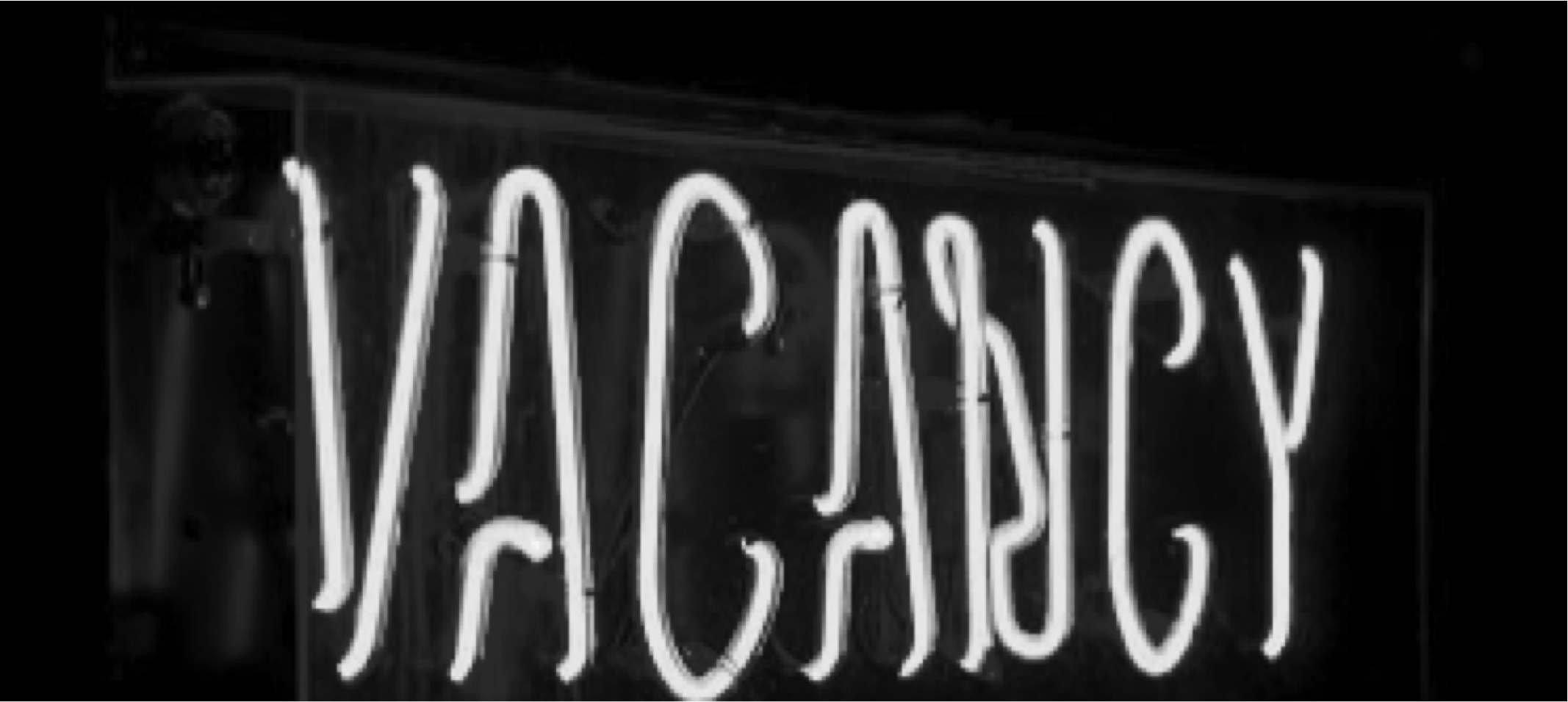

VACANCY

Maybe the scariest part in becoming a Landlord is the likelihood of vacancy. If the house is ever vacant due to no renter or a renter who simply skips town, the income flow abruptly stops and the owner is paying the mortgage if there is one, plus utilities, plus additional insurance required due to it being a vacant home – which is riskier from an insurance standpoint. Vacant homes have higher rates of vandalism, including stealing HVAC and copper, as well as fixtures and appliances.